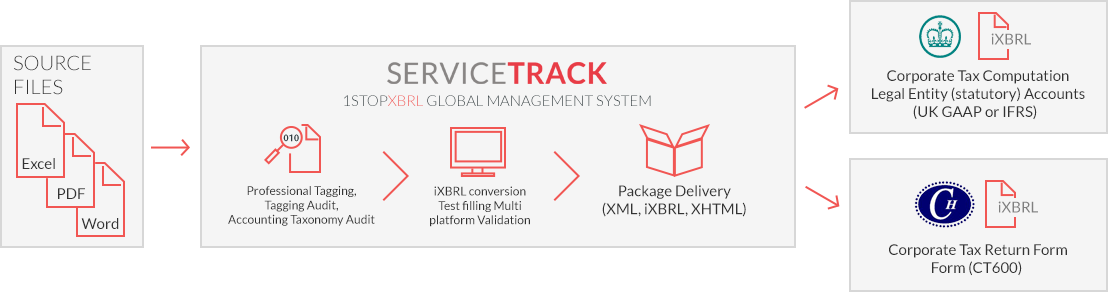

Professional accounts conversion

iXBRL | ESEF | CBCR | FINREP | COREP

100% Success guarantee for compliance & acceptance

Contact Us Now!

Who We Are

1STOPXBRL Limited became one of the first companies to be officially recognised by the HMRC as a provider of Managed Tagging Services back in 2010. Since then, we’ve been a trusted global provider of time sensitive financial documents.

John Sisk & Son Limited and the UK construction group have used 1StopXbrl for the last 5 years – the service received has always been professional, reliable and very good value for money, so much so that we now also use the company for tagging of our Irish construction companies as well. I would highly recommend 1StopXbrl to anyone.

Christina Wilson – Group Accountant

John Sisk & SonAs a complete xbrl novice I found the service provided by 1stop very good. At every step along a fairly complicated and tortuous route there was always someone on the end of the telephone offering help and I was impressed by their patience! I have no hesitation in recommending 1stop for a fast and efficient service.

Lynn Petts

Great Hyde Hall Management Co LtdI would highly recommend using 1Stopxbrl, they were professional, efficient & couldn't have been more helpful, they took all the stress out of converting our accounts in the new format. Thanks, we'll definitely be using your services again!

Juliette Littleton. ACMA

Ceramic Fuel Cells (Europe) LtdWe have been using the services of 1stopxbrl Limited for since May 2011. They have been extremely thorough and professional in their dealings and the support staffs are always helpful when called upon

Mr A Mahmood

Company AssociatesWe have used 1Stopxbrl, for the last five years and found them to be both professional and efficient. They couldn't have been more helpful when dealing with our queries. Based on our experience, I would have no hesitation recommending them to others.

Caroline Allison - Chief Accountant

Samsung ElectronicsWe have used 1stopxbrl for the past 3 years and each time, they have been extremely professional and helpful and their customer service is excellent. We have quite a number of companies within our group and 1stopxbrl converted the accounts in a very efficient manner. We will continue to use their service and would highly recommend them. We’d also like to take this opportunity to thank 1stopxbrl for the fast turnaround on some of the larger accounts and for all their help this year.

Celine Delahunty – Group Accountant

Sisk GroupAs outsourcing providers to financial services market clients we expect high standards from others. 1Stopxbrl have delivered a good level of service to us. As with all new processes there are teething problems, 1Stopxbrl has been excellent in its communication with us to ensure that the process is well managed and that any queries raised are dealt with in a timely manner. We look forward to their continued support and commitment to their current level of service and would recommend them to others.

Katrina Christensen NDA CA - Business Unit Leader

Throgmorton Secretarial Services